Free and Handy Tutoring for Business Students

CHAPTER 1: The Role of

Financial Management

What is Financial Management?

Financial management is concerned with the acquisition, financing, and management of assets with some overall goal in mind. Every financial manager has to deal with investment, financial, and asset management decisions.

Investment Decision.We will encompass the investment decisions aspect that a financial manager has to deal with. When it comes to value creation for a company, investment decision is the most important of the firm's three major decisions( investment, finance, asset-management). Investment decisions include decions about how much money should the company raise/keep, what assets should the company acquire/keep/refine, and so on; so investment decisions are basically about value creation.

Financing Decision. This is the second major decision of the firm. Here the financial manager looks at the right-hand size of the balance sheet, that is the Owner's Equity section. Financing decisions include decisions about equity in general.

Asset Management Decision. This decision is the third important for the firm. Financial managers have the responsibility of managing current assets rather than current liabilities. After insuring a right and accurate financial decision, the financial manager is now required to asset manage the company's envisaged operations.

The Goal of the Firm

The goal of any firm is always to maximize the wealth of the firm's present owners.

Value Creation. This means that financial managers have to maximize the earnings per share for each stockholder, with a dimension that puts into cinsideration the time vector, risk, and a zero dividend-payout ratio. That is the company has to work on increasing the value of shares of stockholders by including the time value of money in its operations, by not engaing in risky operations that may decrease the price per share of each stockholder over the long term, and by making sure that the company does not engage in very long periods of zero dividend-payout ratios.

Agency Problems. Sometimes, problems might arise between the managers of a company and the owners of the same company, such problems are referred to as the agency problems. In order to lessen the extent of quarrels bettween management and owners, it is highly recommended that owners of a firm offer incentives to the managers, such as stock options, bonuses, perks("perks", such as company automobiles and expensive offices), and these incentives must be directly related to how close the management is working for the good of the company's owners.

Corporate Governance

Corporate governance refers to the system by which corporations are managed and controlled. The corporate governance of almost any corporation is constituted of first, the common shareholders, who elect the board of directors, second, the company's board of directors; and, third, the top executive officers led by the chief executive officer(CEO).

This is the end of chapter 1, the Role of Financial Management; in the next chapter we will be looking at the tax environment in order to gain a basic understanding of how tax implications may impact various financial decisions.

Chapter 3: The Time Value of Money

!YOU WILL NEVER UNDERSTAND FINANCE UNTIL

YOU UNDERSTAND THE "TIME VALUE OF

MONEY"!

First, let's watch this nice video that defines the time value of money in a broad sense:

Everyone knows that money deposited in a savings account will earn interest. Because of this universal fact, we would prefer to receive money today rather than the same amount in the future. |

The Interest Rate

Interest is charged by lenders as compensation for the loss of the

asset's use. In the case of lending money, the lender could have

invested the funds instead of lending them out. With lending a large

asset, the lender may have been able to generate income from the asset

should they have decided to use it themselves.

Using the simple interest formula:

Simple Interest = P (principal) x I (annual interest rate) x N (years)

Borrowing $1,000 at a 6% annual interest rate for 8 months means that you would owe $40 in interest (1000 x 6% x 8/12).

Using the compound interest formula:

Compound Interest = P (principal) x [ ( 1 + I(interest rate) N (months) - 1 ]

Borrowing $1,000 at a 6% annual interest rate for 8 months means that you would owe $40.70.

The

interest owed when compounding is taken into consideration is higher,

because interest has been charged monthly on the principal + accrued interest

from the previous months. For shorter time frames, the calculation of

interest will be similar for both methods. As the lending time

increases, though, the disparity between the two types of interest

calculations grows.

Understanding Compound Interest

|

Future Value

The value of an asset or cash at a specified date in the future that is

equivalent in value to a specified sum today. There are two ways to

calculate the future value:

1) For an asset with simple annual interest: = Original Investment x (1+(interest rate*number of years))

2) For an asset with interest compounded annually: = Original Investment x ((1+interest rate)^number of years)

Example 1: FV with a simple annual interest

$1000 invested for 5 years with simple annual interest of 10% would have a future value of $1,500.00.

Example 2: FV with a compound annual interest

$1000 invested for 5 years at 10%, compounded annually has a future value of $1,610.51.

The Present Value

Also referred to as "discounted value".

Formulas: ( assuming compound interest)

FV= P (1+i/m) m*n

where, FV= future value; P= principal at time zero; i= interest rate; m= frequency of compounding; n= number of years.

Present value(also referred to as PV) = FV * 1/ (1+i/m) m*n

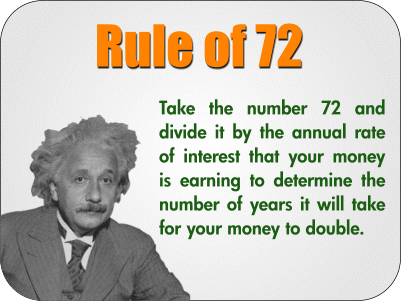

Psst! Want to Double Your Money?

The "Rule of 72" Tells You How

|  |